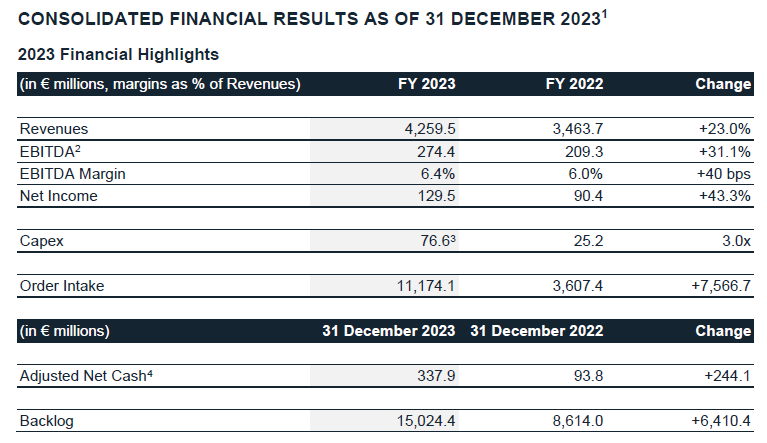

- Double-digit growth in the FY 2023 consolidated Economic and Financial results

- Revenues of €4.3bn (+23.0%), exceeding guidance

- EBITDA of €274.4 million (+31.1%); margin increase also thanks to a higher contribution of Sustainable Technology Solutions

- Net income of €129.5 million (+43.3%)

- Adjusted Net Cash of €337.9 million, up €244.1 million, thanks to a robust operating cash flow

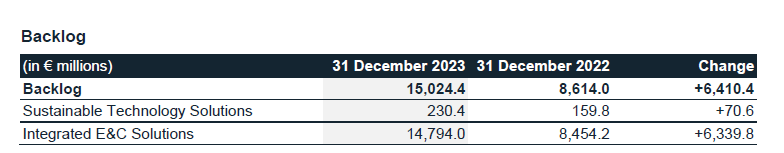

- Order intake at €11.2 billion contributing to a solid backlog of €15.0 billion

- Proposal approved regarding the allocation of profit and a dividend distribution of €0.197/share, up 59% from last year, increasing the pay-out from 45% to 50%

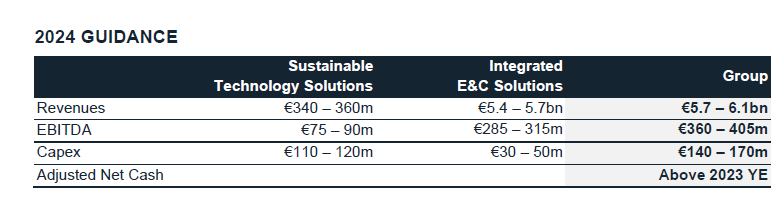

- 2024 Guidance approved, envisaging another year of strong growth

- Revenues: €5.7-6.1 billion (+30-40%), four years earlier than expected in the 2023-2032 Strategic Plan

- EBITDA: €360-405 million (+30-45%)

- Capex: €140-170 million, mainly to expand the technology portfolio

- Adjusted Net Cash: above year-end 2023

- MAIRE unveils its 2024-2033 Strategic Plan

- Downstream investments wave provides massive opportunities with an increase of low carbon solutions, supporting the Group’s further growth

- Sustainable Technology Solutions to leverage its proprietary technologies and process engineering expertise to foster the industry decarbonization and the circular economy with effective end-to-end solutions

- Integrated E&C Solutions to tackle the growth in projects’ size thanks to undisputed execution capabilities, supported by a steady increase in engineering capacity

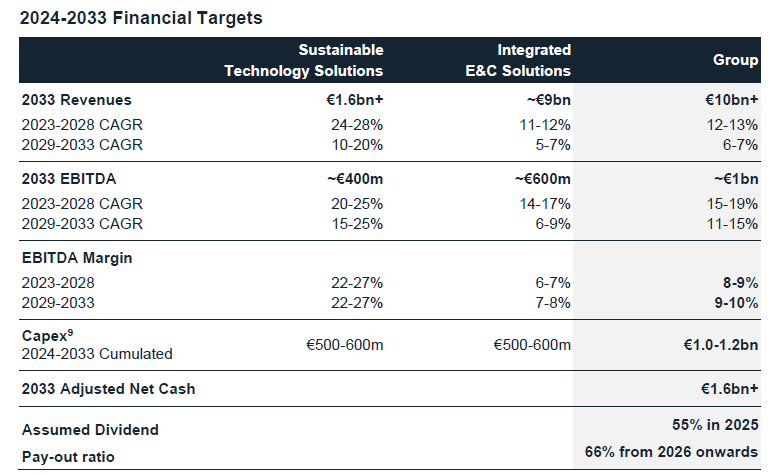

- In 2033 expected Revenues of over €10 billion and EBITDA of around €1 billion, reaching a double-digit margin at the end of the Plan

- More than €1 billion cumulated Capex, including M&A, to boost the technology portfolio and support MET Development initiatives

- Dividend pay-out assumed to increase to 55% in 2025 and 66% from 2026

- Sound cash generation: Adjusted Net Cash expected to exceed €1.6 billion in 2033, notwithstanding cumulated Capex and dividends

- 2023 Sustainability Report approved, containing the Non-financial Statement and the 2024-2033 Sustainability Plan: excellent achievements in the year, upgraded the Group’s Sustainability targets, including carbon neutrality for Scope 1 and Scope 2 emissions anticipated to 2029, one year earlier than originally planned

Milan, 5 March 2023 – The Board of Directors of Maire Tecnimont S.p.A. (“MAIRE” or the “Company”) met today to review and approve the 2023 Draft Statutory and the Group’s Consolidated Financial Statements, as well as the 2024-2033 Strategic Plan, which will be both presented today by the Top Management during the “OUT OF THE unBOX” Capital Markets Day.

Alessandro Bernini, Chief Executive Officer of MAIRE, commented: “We are extremely satisfied with the results we presented today. Our strategic choices announced last year are proving their validity and being rewarded by a positive reaction from the market. MAIRE is delivering double digit growth across its main financial indicators. Increased profit margin on revenues demonstrates our efficient management of operations. The Sustainable Technology Solutions business unit is making an increasing contribution, with revenues up 40%. Our technology leadership has been strengthened as we expand our portfolio of solutions to support our customers' decarbonization goals. Above all, today we are reporting an acceleration of revenues that as recently as last year we had only expected to reach in 2028. We have won orders worth more than €11 billion, successfully leveraging the downstream investment super cycle and bringing our portfolio to €15 billion. We continue to expand our operating centers by adding new ones. In 2023, engineering capacity as measured in man-hours grew by 20% over 2022. None of this would have been possible without the highly skilled and hard-working professionals who contribute daily to the achievement of our goals. Our people and their talents are our main assets and we will continue to invest in them.”

Revenues were €4,259.5million, up 23.0%, mainly thanks to the progress of projects under execution, which generate higher volumes.

EBITDA was €274.4 million, up 31.1%, thanks to higher revenues and the efficient management of overhead costs. EBITDA Margin was 6.4%, up 40 basis points, thanks to an increased contribution from technologies and high value-added services.

Amortization, Depreciation, Write-downs, and Provisions were €57.9 million, slightly higher due to the start into operation of new patents and technological developments, as well as assets for the digitalization of industrial processes.

EBIT was €216.5 million, up 37.1%, with a margin of 5.1%, up 50 basis points.

Net Financial Charges were €30.3 million, compared to €28.9 million, due to the impact of the increase in interest rates on the new credit facilities taken on during the year, partial offset by a higher yield on cash deposits.

Pre-tax Income was €186.2 million and the tax provision was €56.7 million. The effective tax rate was 30.5%, substantially in line with the last quarters.

Net Income was €129.5 million, up 43.3%, with a 3.0% margin, up 40 basis points. Group Net Income was €125.4 million, up 39.5%.

Adjusted Net Cash as of 31 December 2023, excluding leasing liabilities (IFRS 16) and other minor items, was €337.9 million, increasing by €244.1 million versus the end of December 2022. Cash generation benefitted from the advance payments on the strong order intake, more than compensating dividends of €40.7 million, the share buy-back program of €3.8 million and capital expenditures for a total value of €76.6 million. Capex in the period is composed of €43.2m of M&A Capex[1] and €33.4m of Organic Capex, mainly dedicated to the expansion of the technology portfolio and to digital innovation projects.

Consolidated Shareholders’ Equity was €579.7 million, up €51.6 million versus 31 December 2022, positively impacted by the Net Income of the period, net of the dividends and the share buy-back.

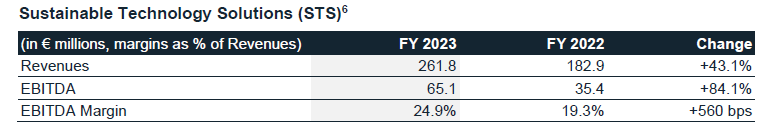

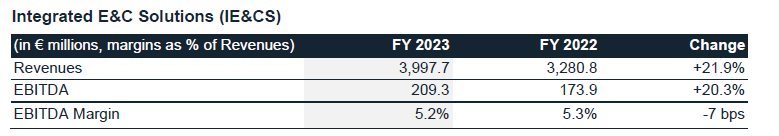

PERFORMANCE BY BUSINESS UNIT

The results by business unit reported below are consistent with the new organizational and reporting structure adopted by Group starting from the 2023 financial year, compared with the pro-forma figures as of 31 December 2022.

Revenues amounted to €261.8 million, up 43.1%, thanks to the constant growth recorded in technological solutions and services in nitrogen fertilizers and low-carbon circular fuels and chemicals.

EBITDA was €65.1 million, up 84.1%, thanks to higher volumes and a different mix of technological solutions, with a 24.9% margin, up 560 basis points.

Revenues amounted to €3,997.7 million, up 21.9%, mainly thanks to the steady execution of projects mainly in polymers and fuels and chemicals, as well as to the contribution of the contracts awarded in the last months.

EBITDA was €209.3 million, up 20.3%, and with a margin of 5.2%, in line.

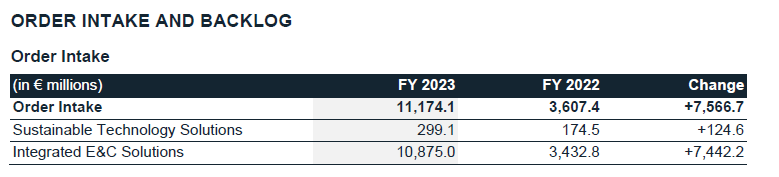

The 2023 Order Intake was €11,174.1 million, up €7,566.7 million compared to €3,607.4 million in 2022.

In particular, the Sustainable Technology Solutions business unit generated new orders for €299.1 million. The main projects awarded in the fourth quarter to this business unit include:

- licensing, process design package and catalyst supply for CONSER proprietary Duetto technology for biodegradable plastics intermediates in China;

- an engineering design study for the first green synthetic fuels pilot plant in Italy, where NextChem will apply its proprietary NX CPOTM technology to boost carbon efficiency;

- a process design contract based on “Waste-to-X” proprietary technology for a bio-waste to SAF facility in the USA;

- licensing and equipment supply contracts for a “Ultra-Low Energy” urea plant in China;

- a feasibility study for the transformation of solid waste into Sustainable Aviation Fuel in the UAE.

The Integrated E&C Solutions business unit generated new orders for €10,875.0 million, including the multi-billion Dollar Hail and Ghasha contract. The other awards of the fourth quarter include:

- over €100 million of new contracts awarded for a hydrogen production unit and a hydrocracked base oil plant in Europe;

- a small award for renewable energy in India.

For the details on the awards of the first three quarters of 2023, please refer to the corresponding 2023 Financial Results press releases.

As a result of the full-year order intake, the Group's Backlog at 31 December 2023 amounted to €15,024.4 million, a 1.7x increase compared to 31 December 2022.

SUBSEQUENT EVENTS AFTER THE CLOSE OF THE YEAR

Agreement with newcleo

In January 2024, NextChem Tech signed a cooperation agreement with newcleo to develop a conceptual study for carbon-neutral hydrogen production thanks to newcleo’s innovative clean and safe nuclear technology. The collaboration will support the development of the “e-Factory for carbon-neutral chemistry” aimed at producing sustainable chemicals through NextChem’s technology solutions, powered by newcleo’s generation IV small-scale modular reactor (SMR) to be supplied on an exclusive basis for the chemical sector.

Acquisition of HyDEP and Dragoni Group

On 21 February 2024, NextChem Tech signed a binding agreement to acquire 80% of HyDEP S.r.l. and 100% of Dragoni Group S.r.l., engineering services companies engaged in the mechanical and electrochemical sectors with a strong process design expertise in green hydrogen. The purchase price for the two stakes is approximately €3.6 million. Closing is subject to certain conditions precedent and is expected in the second quarter of 2024. NextChem will leverage on HyDEP’s competences to develop its own innovative electrolysis technology.

Acquisition of GasConTec

On 4 March 2024, NextChem signed a binding agreement to acquire 100% of the German based company GasConTec GmbH (“GCT”). GCT owns over 80 patents and significant know-how in the production of several products, including low carbon hydrogen, ammonia and methanol, which are strategically complementary to NextChem’s portfolio.

The agreement provides for an overall consideration of €30 million[1]. Closing is subject to certain conditions precedent customary for this kind of transactions and is expected in the second quarter of 2024.

Contracts awarded Year-to-Date

The main contracts awarded to Sustainable Technology Solutions year-to-date include:

- a Pre-Front End Engineering Design for the gasification and methanation of waste wood, as well as the implementation of a carbon capture unit, at Engie’s Salamandre project in France, which aims to produce 2nd generation biomethane;

- licensing and engineering design package for the application of the proprietary NX CPOTM technology in an industrial-scale plant that will produce Sustainable Aviation Fuel in Norway;

- licensing and equipment supply related for a urea melt plant in China based on Stamicarbon’s proprietary Ultra-Low Energy design;

- licensing and equipment supply based on Stamicarbon’s proprietary technology for a urea melt and granulation plant in Egypt.

The main contracts awarded to Integrated E&C Solutions year-to-date include:

- a Front-End Engineering Design for a large-scale green ammonia plant in Norway;

- a Front-End Engineering Design for a green hydrogen and ammonia plant in Portugal;

- an Engineering, Procurement and Construction contract for a hydrogen production unit, as part of ENI’s conversion of its Livorno site into a biorefinery.

The execution of the current backlog supports a strong growth in revenues in 2024, thanks to projects which are progressing toward the construction phase and the early contribution of engineering and procurement activities of Hail and Ghasha. 2024 Revenues are expected to reach a level which was envisaged only in 2028 under the 2023-2032 Strategic Plan.

Profitability will benefit from the contribution of innovative technology solutions and higher-value services, as well as from the start of projects with higher margins.

Capital expenditures will be focused on the technology portfolio expansion to foster energy transition, including via selected add-on acquisitions, such as the recently announced HyDEP and GasConTec, and digital innovation.

Notwithstanding higher investments and the proposed dividend distribution, Adjusted Net Cash is expected to improve compared to the end of 2023.

PROPOSAL ON THE ALLOCATION OF PROFIT AND DIVIDEND DISTRIBUTION OF €0.197 PER SHARE

The Board of Directors resolved today to propose to the Ordinary Shareholder’s Meeting to allocate the €34,880,399.88 net income of Maire Tecnimont S.p.A. as dividend and – taking into account the “Retained Earnings Reserve” amounting to €11,838,174.84 and the “Extraordinary Reserve” amounting to €117,682,064.95 – to distribute a dividend of €0.197[1], gross of withholding taxes, for each of the 328,517,346 outstanding ordinary shares, with no par value, as of today and entitled to a dividend, up 59% versus last year.

Based on the outstanding ordinary shares entitled to dividend as of today the total proposed dividend amount is €64,717,917.16, corresponding to a 50% pay-out, increased from 45% in 2023, to be deducted for the amount of €11,838,174.84 from the “Retained Earnings Reserve”, (which will be integrally used) for the amount of €17,999,342.44 from the “Extraordinary Reserve” and for the amount of €34,880,399.88 from the 2023 net income.

The Board of Directors resolved the payment of the dividend will be paid from April 24th, 2024 (so-called payment date) and with a coupon detachment (coupon number 90) on April 22nd, 2024 (so-called ex-date). Pursuant to article 83 terdecies of the Legislative Decree 24 February 1998 number 58, the entitlement to pay the dividend is determined with reference to the evidence in the intermediary's accounts pursuant to article 83 quater, paragraph 3, of the same Legislative Decree 58/98, at the end of the business day of April 23rd, 2024 (so-called record date).

2024-2033 STRATEGIC PLAN

The Board of Directors resolved today to approve the 2024-2033 Strategic Plan, which, following the strategic approach and new organizational model launched last year, is unveiled by MAIRE.

The global energy scenario is characterized by massive investment plans aimed at addressing the challenges of energy security and climate change. In the transition to a low carbon system, while investments in clean energy are expected to grow sharply, decarbonisation features will be increasingly applied to existing and new downstream assets. The energy supercycle requires proven and effective technologies, combined with the capability to deliver complex projects which are becoming larger in size. The Group’s value proposition, integrating technological leadership with execution excellence, represents a source of competitive advantage in this complex and fast environment.

Sustainable Technology Solutions will continue to leverage its process engineering expertise to integrate its proprietary technologies, supporting clients with comprehensive and effective end-to-end solutions in Nitrogen Fertilizers, Hydrogen and Circular Carbon, Fuels and Chemicals and Polymers, all key to the industry decarbonization. NextChem is taking advantage of a broad portfolio of proprietary low carbon and circular technologies, to be further enhanced in strategic segments including Sustainable Aviation Fuels and innovative electrolysis solutions. At the same time, it is working to expand its offering in catalysts, fundamental to chemical processes. This impressive innovation will be driven by strategic and incremental R&D, partnerships and add-on acquisitions of proven technologies or competences to be scaled-up. The internally developed STAMI Green AmmoniaTM and NX CPOTM proprietary technologies, introduced to the market in 2023, as well as the acquisitions of Conser and MyRemono, are just a few examples of this successful model. An additional boost will come from the “Green Innovation District”, a hub of innovation to leverage advanced R&D facilities and resources, including pilot plants, that is being established in the historical Group’s headquarters in Rome.

In parallel, Integrated E&C Solutions will tackle the growth in number and size of energy projects leveraging on its undisputed execution capabilities. This operational excellence model will be supported by the steady increase in engineering capacity in existing and new operating centres spread across the globe. Additionally, procurement will be focused on expanding and further diversifying the supply chain, in order to secure quality capacity with vendors and sub-contractors prioritizing local spending, in line with the Group’s commitment to keep fostering the in-country value. All these activities will benefit from the use of digital solutions, including the growing adoption of advanced Artificial Intelligence tools, which will boost productivity and quality of delivery.

In the 2024-2033 Strategic Plan, MAIRE expects a significant growth in its key financial performance indicators, while preserving its financial solidity and flexibility.

Revenues are expected to exceed €10 billion and EBITDA to reach approximately €1 billionin 2033. The strongest growth in volumes is envisaged in the first five years, while profitability will benefit from an increasing contribution of the technology business and higher value-added integrated projects.

This relevant and accelerated expansion will be achieved also through more than €1 billion of Capex over the plan’s horizon. Capex in the STS business unit will be concentrated in the first years of the plan and will be dedicated to the expansion of the technology portfolio and the validation of new solutions, both through selective add-on acquisitions and internal R&D. Capex in the IE&CS business unit will include small M&A transactions to expand engineering capacity, recurring investments for the implementation of the MET Zero Plan and digital innovation initiatives, as well as co-investments in selected projects where STS proprietary technologies are applied (the so called “First-of-a-Kind” initiatives).

In particular, MAIRE’s subsidiary MET Development is expected to act as a minority equity investor in selected projects where STS innovative technologies are adopted and IE&CS is involved in the execution phase. Average equity funding is expected to be €10-20 million for each initiative, potentially in co-investment with infrastructure funds, for a total of €320-€370 million[1] allocated over the plan horizon.

Notwithstanding the important investment plan, the Group intends to maintain a sound and flexible financial structure. Adjusted net cash is expected to reach approximately €500 million in 2028 and exceed €1.6 billion in 2033, also thanks to a more normalized level of Capex and the returns from the above mentioned “First-of-a-Kind” initiatives in the second half of the plan. A significant reduction in gross debt and an increase in the dividend pay-out ratio to 55% in 2025 and 66% from 2026 onwards are assumed in the plan.

UPDATE ON THE ORGANIC GROWTH OF THE GROUP

To support the Group’s growth, MAIRE continues to invest in acquiring new talents. Headcount reached around 8,000 employees from about 80 nationalities as of 31 December 2023, up 24% since the end of 2022, also thanks to over 1,300 engineers hired during the year, more than half in India. While the headcount is expected to keep growing significantly to fuel the growth ambitions envisaged in the 2024-2033 Strategic Plan, the Group remains deeply committed to the flourishing of its people and to fostering an even more diverse and inclusive environment.

2023 SUSTAINABILITY REPORT AND 2023-2033 SUSTAINABILITY PLAN APPROVED

The Board of Directors resolved today to approve the 2023 Sustainability Report – containing the Non-financial Statement under Legislative Decree no. 254/2016 – and the 2024 -2033 Sustainability Plan. 2023 has been a strong year for the Group’s Sustainability. Main 2023 achievements in the 5 Sustainability clusters include:

ENVIRONMENT:

- 26% reduction in Scope 1 and 2[1] emissions compared to the 2018 baseline, in line with the 35% reduction target in 2025 established in the Sustainability-Linked Financing Framework, according to which MAIRE issued its €200 million Sustainability-Linked bond in October 2023

- 5% reduction in Scope 3 emissions intensity[2]

PEOPLE:

- Approximately 50 total hours of training / year per employee

- 2.4 million hours of HSE training on construction sites (+86%), equal to 3.4% of hours worked[3]

- 138,000 hours of non-HSE training in 2023, out of which 18,000 on Sustainability, Diversity and Human Rights

- LTIR[4] 60% better than the industry average

- 8 audits on Human Rights (SA8000)

INNOVATION:

- 2.253 patents (+10%)

- 29 agreements with universities (+20%)

COMMUNITIES:

- Over 70% of total expenditure purchased from ESG-screened suppliers

- 52% of project costs for goods and services purchased locally[5]

- 10 Corporate Social Responsibility initiatives in 5 countries

GOVERNANCE:

- Approximately 80% of employees trained on Business Integrity

- Maintained 44% of women in MAIRE’s Board of Directors

- 60% of board meetings with sustainability topics

- Over 1,500 people involved in stakeholders engagement

- First MAIRE Sustainability Day

The 2024-2033 SUSTAINABILTY PLAN INCLUDES, AMONG OTHERS, THE FOLLOWING TARGETS:

- Carbon neutrality target for Scope 1 and 2 emissions accelerated to 2029, one year earlier than originally planned

- 9% reduction in Scope 3 emission intensity[6] in 2025, carbon neutrality by 2050

- Issuance of the first TCFD (Task Force on Climate-related Financial Disclosures) Report in 2024

- Expansion of the Group’s technological portfolio with 7 new technologies supporting the Energy Transition by 2025

- +10% of patents linked to sustainable solutions in 2024

- From 10 to 20% ESG objectives in variable compensation (MBO and LTI)[7]

- 1/3 of women in the BoDs of the main subsidiaries in 2024

- Alignment to SBTi (Science-based Targets initiative) in 2024

UPDATE ON THE EURO COMMERCIAL PAPER PROGRAMME

With reference to the Euro Commercial Paper program launched in 2021 by MAIRE for the issuance of one or more non-convertible notes placed with selected institutional investors for a maximum amount of €150 million, it should be noted that as at 31 December 2023 the program is utilized for an amount of €21.6 million. The notes will expire in January, February, March, July and December 2024. They bear a weighted average interest rate of approximately 5.229%.

***

“OUT of the unBOX” CAPITAL MARKETS DAY - WEBCAST AND CONFERENCE

The top management of MAIRE will present the FY 2023 Financial Results and the 2024-2033 Strategic Plan during its “OUT of the unBOX” Capital Markets Day today at 3:00pm CET.

The live stream of the event can be accessed at the following link:

mairecapitalmarketsday.it/online/

Alternatively, you may join by phone using one of the following numbers:

Italy: +39 02 8020911

UK: +44 1 212818004

USA: +1 718 7058796

The presentation will be available at the start of the event in the “Investors/Financial Results” section of MAIRE’s website (Financial Results | Maire (mairetecnimont.com)). The presentation shall also be made available on the “1info” storage mechanism (www.1info.it).

***

Fabio Fritelli, as Executive for Financial Reporting, declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The 2023 Draft Statutory and Group’s Consolidated Financial Statements will be available to the public at the registered office in Rome, at the operative office in Milan, on the Company’s website www.mairetecnimont.com (in the “Investors/Financial Results” section), and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law.

The 2023 Sustainability Report, containing the Non-financial Statement under D. Lgs. 254/2016, will be published as provided by law, at the Company’s registered office in Rome and the operative offices in Milan, on the website www.mairetecnimont.com ("Investors/Financial Results” section – "Sustainability for Investors"), as well as on the "1info" authorized storage mechanism (www.1info.it).

This document makes use of some alternative performance indicators. The management of the Company considers these indicators key parameters to monitor the Group’s economic and financial performance. As the represented indicators are not identified as accounting measurements according to IFRS standards, the Group calculation criteria may not be uniform with those adopted by other groups and, therefore, may not be comparable.

This press release includes forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including altered macroeconomic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.

***

MAIRE S.p.A. leads a technology and engineering group that develops and implements innovative solutions to enable the Energy Transition. We offer Sustainable Technology Solutions and Integrated E&C Solutions in nitrogen fertilizers, hydrogen, circular carbon, fuels, chemicals, and polymers. MAIRE creates value in 45 countries and relies on around 8,000 employees, supported by over 20,000 people engaged in its projects worldwide. MAIRE is listed on the Milan Stock Exchange (ticker “MAIRE”).

For further information: www.mairetecnimont.com.

Group Media Relations Carlo Nicolais, Tommaso Verani Tel +39 02 6313-7603 | Investor Relations Silvia Guidi Tel +39 02 6313-7823 |