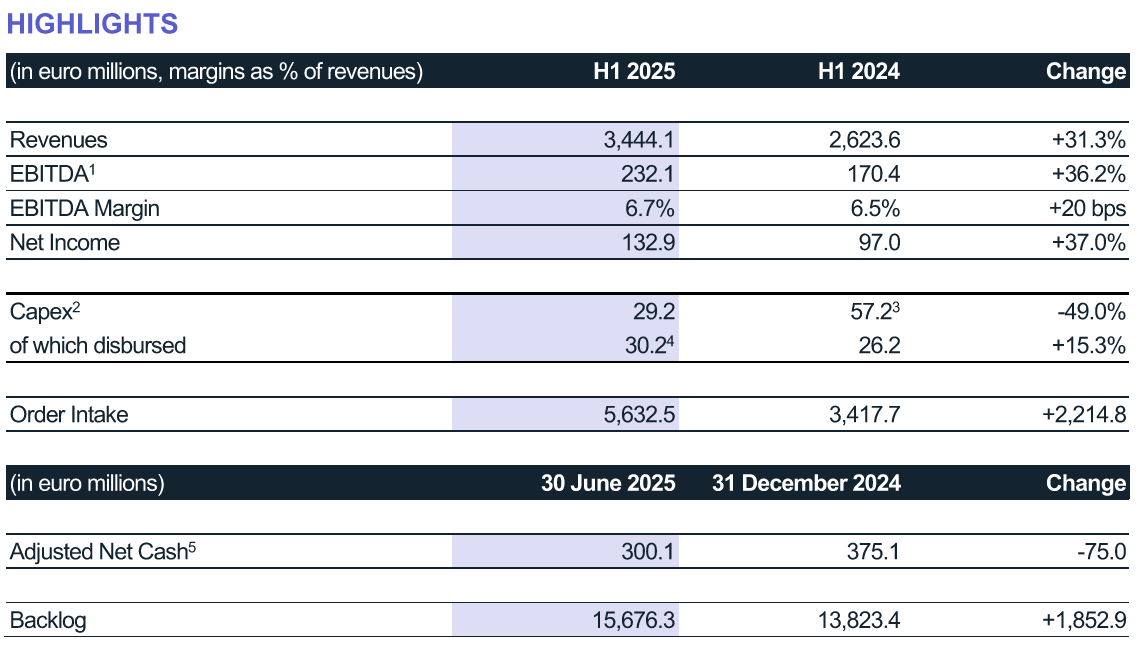

MAIRE’s First Half 2025 consolidated results. Strong H1 performance supports upward revision of full year Revenue and EBITDA Guidance

PRESS RELEASE- Main economic results up double-digits

‒ Revenues: €3.4 billion (+31.3%)

‒ EBITDA: €232.1 million (+36.2%) with a margin increase from 6.5% to 6.7%

‒ Net income: €132.9 million (+37.0%)

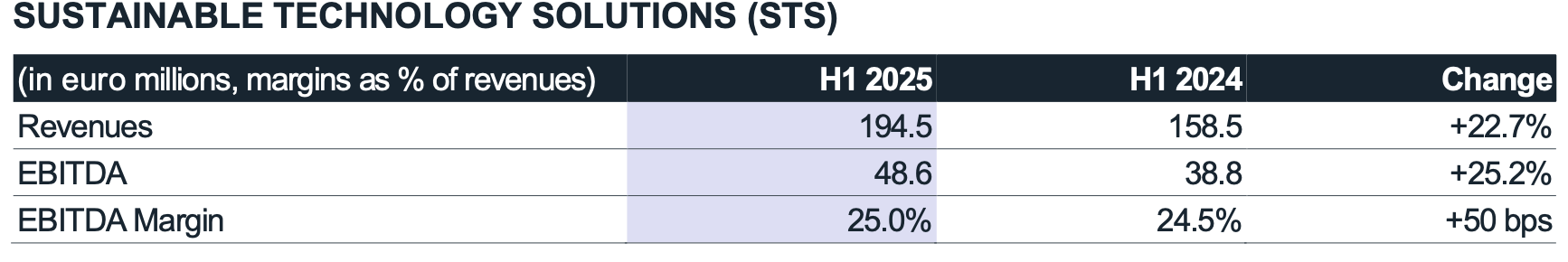

- NEXTCHEM(Sustainable Technology Solutions) revenues of €194.5 million (+22.7%) and EBITDA of €48.6 million (+25.2%), with a margin increase from 24.5% to 25.0%

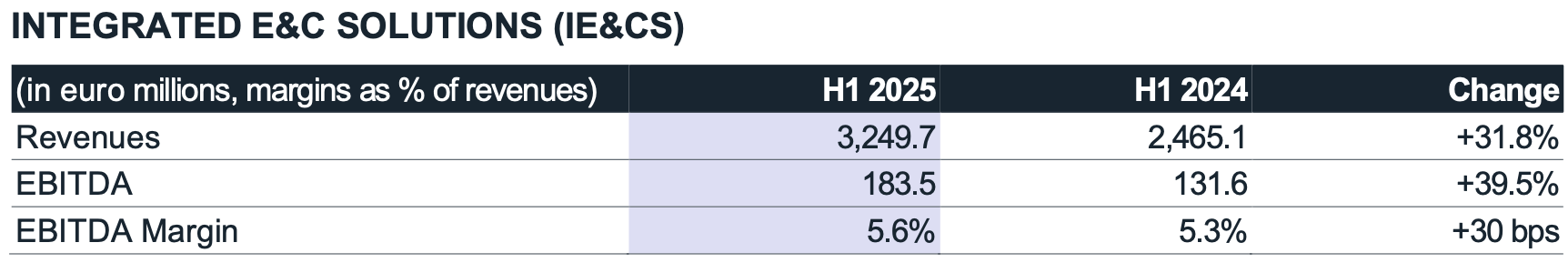

- TECNIMONT and KT (Integrated E&C Solutions) revenues of €3.2 billion (+31.8%) and EBITDA of €183.5 million (+39.5%), with a margin increase from 5.3% to 5.6%

- Adjusted net cash position of €300.1 million as of 30 June 2025 (€375.1 million as of 31 December 2024), net of €119.5 million of dividend payments, €63.4 million of buy-back program to support the incentive plan, and €30.2 million of capex in the first half

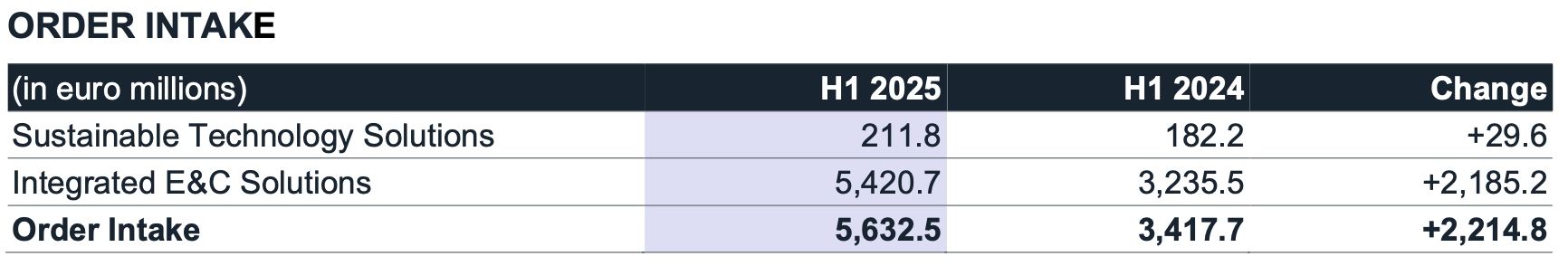

- Order intake of €5.6 billion, mainly in new strategic geographies, leading to a solid backlog of €15.7 billion

- Confirmed the expectations for overall €8 billion of full year order intake

- Headcount reaches 10,200 people, in line with the Group’s expansion

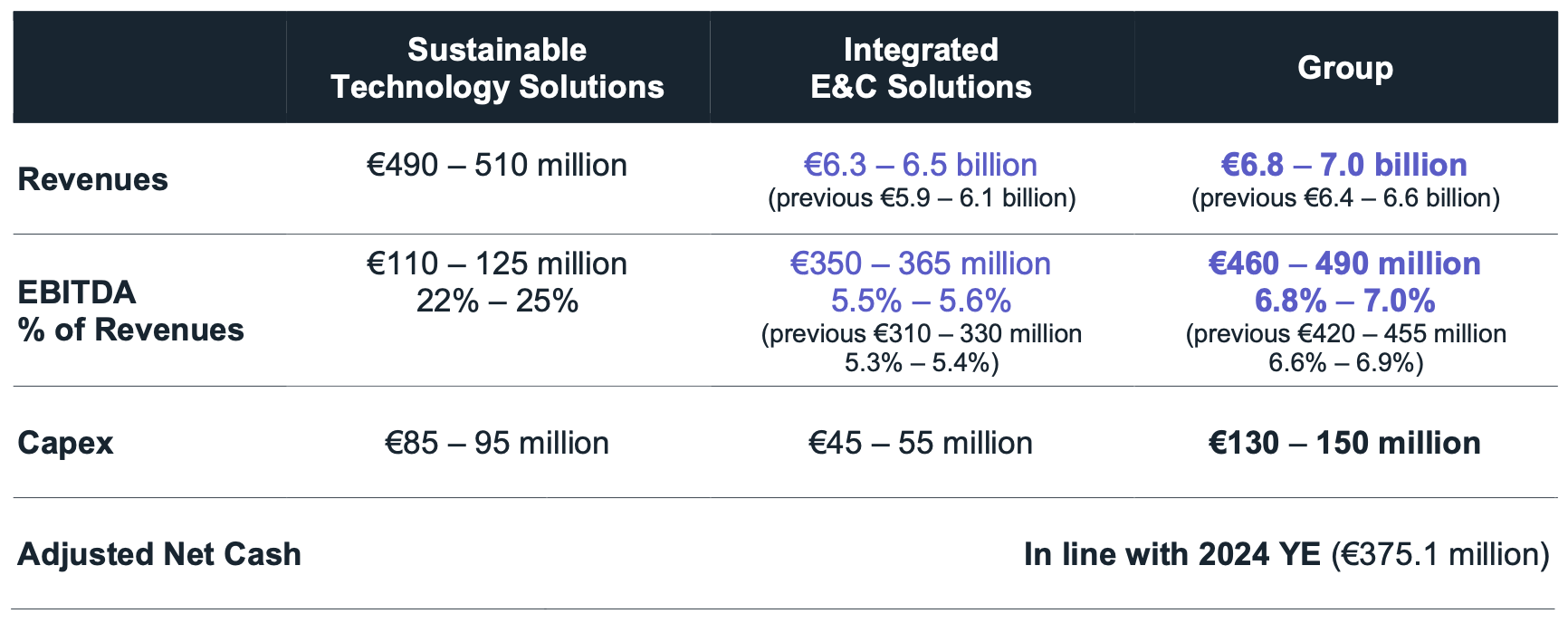

- 2025 guidance revised upward for revenue and EBITDA thanks to significant backlog and timely project execution

- Group: upward revision of revenues, equal to €6.8 – 7.0 billion (vs. €6.4 – 6.6 billion) and EBITDA, equal to €460 – 490 million (vs. €420 – 455 million), with a margin of 6.8 – 7.0% (vs. 6.6 – 6.9%)

- Sustainable Technology Solutions: revenues (€490 – 510 million) and EBITDA (€110 – 125 million) confirmed

- Integrated E&C Solutions: upward revision of revenues, equal to €6.3 – 6.5 billion (vs. €5.9 – 6.1 billion) and EBITDA, equal to €350 – 365 million (vs. €310 – 330 million), with a margin of 5.5 – 5.6% (vs. 5.3 – 5.4%)

- Group capex (€130 – 150 million) and adjusted net cash position (in line with 2024 YE equal to €375.1 million) confirmed

- NEXTCHEM obtained a Legality Rating certification by the Italian Competition Authority with the top score

Milan, 31 July 2025 – The Board of Directors of MAIRE S.p.A. (“MAIRE” or the “Company”) met today to review and approve the Group’s Half Year Consolidated Financial Report as of 30 June 2025.

Alessandro Bernini, MAIRE Chief Executive Officer, commented: “The first half of 2025 has been a period of sustained growth and expansion in various strategic regions, with operational performance exceeding expectations thanks to rigorous project execution, and also to NEXTCHEM’s constant growth. The operational result already achieved and the size of our existing backlog allows us to revise our 2025 guidance upwards. With 5.6 billion euro in new awards and a 15.7 billion euro backlog at the end of June, we have significantly diversified our geographic footprint and reinforced our global competitiveness. These results reflect our unwavering commitment to value creation, innovation, sustainable growth and the dedication of our people, whose expertise and passion are at the heart of our success.”

CONSOLIDATED FINANCIAL RESULTS AS OF 30 JUNE 20256

Revenues were €3.4billion, up 31.3%, thanks to the consistent progress of projects under execution.

EBITDA was €232.1 million, up 36.2%, driven by higher revenues and the efficient management of overhead costs. EBITDA Margin was 6.7%, up 20 basis points, also thanks to the contribution from higher value-added services.

Amortization, Depreciation, Write-downs, and Provisions were €32.5 million, slightly up.

EBIT was €199.7 million, up 42.9%, with a margin of 5.8%, up 50 basis points.

Net financial charges were €4.8 million, compared to €2.9 million of net financial income in the first half of 2024, also taking into account the variation of the mark-to-market of derivative instruments.

Pre-tax Income was €194.9 million and the tax provision was €62.0 million. The tax rate was 31.8%, reflecting the various jurisdictions in which the Group’s operations have been carried out.

Net Income was €132.9 million, up 37.0%, with a 3.9% margin, up 20 basis points.

Adjusted Net Cash3 as of 30 June 2025 was €300.1 million, compared to €375.1 million as of 31

December 2024, net of outflows for the dividends of €119.5 million7, for the share buy-back program of €63.4 million, and for capital expenditures of €30.2 million, which were mainly dedicated to the internal development and scale-up of new technologies and to digital innovation projects.

Consolidated Shareholders’ Equity was €616.8 million, compared to €641.1 million as of 31 December 2024, as a result of the dividend payments and the impact of exchange rate fluctuations, partially offset by the profit of the period.

PERFORMANCE BY BUSINESS UNIT

Revenues were €194.5 million, up 22.7%, driven by technological solutions and services mainly for the production of low-carbon and circular fuels, nitrogen fertilizers, as well as for carbon capture.

EBITDA was €48.6 million, up 25.2%, supported by higher volumes, with a margin of 25.0%, up 50 basis points, as a result of the contributions from licensing and high value-added engineering services in the product mix during the period.

Revenues were €3.2 billion, up 31.8%, thanks to the steady execution of projects, including the Hail and Ghasha in Abu Dhabi, the other main contracts in the Middle East, as well as the ramp-up of projects acquired in Algeria last year.

EBITDA was €183.5 million, up 39.5%, with a margin of 5.6%, up 30 basis points, benefitting also from a higher operating leverage.

ORDER INTAKE AND BACKLOG

In particular, the Sustainable Technology Solutions business unit, led by NEXTCHEM, generated new orders for €211.8 million. The main projects awarded in the first half include:

• a licensing contract for a hydrogen production unit in Malaysia;

• a process design package to upgrade a fertilizer plant in China;

• a contract for high value-added engineering services for a waste-to-chemical project in Southern Europe;

• a proprietary equipment contract for a project aimed at producing low-carbon fuels in Sub- Saharan Africa;

• a three-year contract to provide engineering and technology services for the Sulphur Recovery Complex at Jubail refinery, in Saudi Arabia;

• a contract for an engineering study related to a CO2 capture project in Italy;

• a licensing contract and process design package for a maleic anhydride plant in China.

The Integrated E&C Solutions business unit generated new orders for €5.4 billion. The main contracts awarded in the first half include:

• an EPC for a hydrogen production unit by Pengerang Biorefinery in Malaysia;

• an EPC for the Silleno petrochemical complex in Kazakhstan;

• an EPC for a complex upgrade aimed at producing low-carbon fuels in Sub-Saharan Africa;

• an EPCm for a green hydrogen unit within an existing refinery in Southern Europe;

• an EPC for the Tengiz gas separation complex in Kazakhstan.

Silleno project

The project entails the development of a petrochemical complex with a production capacity of 1,250 thousand tons per year of polyethylene in the Atyrau region of Kazakhstan. The project, awarded in March 2025 for an overall value of $3.6 billion, will be executed by a joint venture led by TECNIMONT. The engineering activities have already started, while mechanical completion is expected at the end of 2028.

The scope of work includes engineering services, equipment and material supply, and construction activities up to the mechanical completion, along with the relevant utilities, infrastructure and offsite facilities for the entire complex. The contract also includes for the commissioning services on a reimbursable basis until the start-up and the guarantee test run.5

Tengiz project

The project, awarded in May 2025, entails the development of a Gas Separation Complex (GSC) produced at the Tengiz field in the Atyrau Region of Kazakhstan in order to feed natural gas to the Silleno plant mentioned above.

The project will be executed by a consortium and the scope of work includes the engineering, procurement, construction and commissioning works.

The contract value for TECNIMONT is approximately $1.1 billion and the company will be mainly responsible for the engineering, procurement and commissioning activities. The completion date is expected in the first quarter of 2029.

As a result of the order intake of the period, the Group's Backlog at 30 June 2025 amounted to €15.7 billion.

UPDATE ON THE HAIL AND GHASHA PROJECT

The Hail and Ghasha project, awarded to TECNIMONT in October 2023 for $8.7 billion, is progressing as planned, with completion expected in 2028. As of the end of June 2025, the project team has reached an overall progress of 33% and over eighteen million safe man-hours. Engineering works are advancing, with some tasks ahead of schedule, reaching a 69% progress. Procurement is 90% complete, with manufacturing activities in progress and first bulk material shipments.

Construction is accelerating, reaching a 15% progress, with field facilities almost completed and initial equipment installations underway.

SIGNIFICANT EVENTS AFTER THE CLOSE OF THE PERIOD

Contract award for the Pacifico Mexinol project

On 1 July 2025, MAIRE announced that NEXTCHEM has been awarded a €210 million contract for the basic engineering and the supply of critical proprietary equipment for the Pacifico Mexinol ultra- low carbon methanol project in Mexico. This contract, which follows the licensing award announced last February, is subject to a final investment decision, expected in the fourth quarter of 2025.

OUTLOOK

Amid a fast-changing environment, the Group benefits from a solid backlog, further strengthened and diversified by the recent awards, and composed by projects which are not directly impacted by the current geopolitical tensions. At the same time, the demand for innovative technological solutions and, more in general, the downstream segment, are characterised by robust and resilient fundamentals, suitable to bring additional commercial opportunities that may materialize into new contracts in the coming months, in line with the forecast of €8 billion of order intake for 2025.6

2025 guidance

The Group reported a strong operating performance in the first half of the year, driven by a punctual execution of projects, particularly in the Middle East and North Africa.

The planned activities of the existing projects are expected to confirm the same trend in the second half of the year, supporting revenue growth and margin expansion of the IE&CS business unit in 2025. At the same time, the STS business unit is expected to accelerate in the second half of the year, driven by the recent awards, as well as by projects which are likely to be acquired in the coming months, benefitting from the integrated offering with the IE&CS business unit.

The excellent operational performance of the first half and the resulting improved visibility on the second half of the year has led to an upward revision of the Group’s 2025 revenue and EBITDA guidance, while confirming all the other KPIs8.

UPDATE ON THE ORGANIC GROWTH OF THE GROUP

To support the Group’s growth, MAIRE continues to invest in acquiring new talent. Headcount reached 10,179 employees as of 30 June 2025, an increase of 440 professionals compared to 31 December 2024.

UPDATE ON THE EXECUTION OF THE SUSTAINABILITY PLAN

During the first half of 2025, MAIRE made progress in implementing the Group's sustainability strategy. The environmental, social, and governance commitments as well as oversight methods are set forth in the new sustainability policy, inspired by the Group’s strategy and implemented through an ESG plan, based on a thorough double materiality analysis, aligned with the Corporate Sustainability Reporting Directive and consistent with the business plan. The Sustainability Policy is available on the Group's website at Sustainability strategy | Maire.

Social impact

On the social front, MAIRE and NEXTCHEM have achieved DNV certification of compliance with the UNI PdR 125:2022 standard on gender equality in the workplace. This is a significant achievement for the Group, which has always been committed to diversity, equity, and inclusion, and specifically to strengthening women presence in the industry, with numerous initiatives designed for the community, schools, and universities, with the objective of reaching gender equality in new hires by 2032.

Environmental impact

With its latest photovoltaic plant operating in the United Arab Emirates, the Group has reached 3MW of installed renewable energy capacity across temporary construction facilities which host the workforce serving the project execution. The renewable energy production plants will contribute to achieving the Group's target of carbon neutrality by 2029 for Scope 1 and 2 emissions, produced by fuel and electricity consumption in offices and construction sites. Also in the United Arab Emirates, a reverse osmosis plant for water desalination has become operational to reduce freshwater withdrawal.

Governance

NEXTCHEM obtained a Legality Rating certification by the Italian Competition Authority with a top score on 29 July 2025.

***

CONFERENCE CALL AND WEBCAST

The top management of MAIRE will present the First Half 2025 Results during a conference call today at 5:30pm CEST.

The live stream of the event can be accessed at the following link: MAIRE H1 2025 Results Conference Call

Alternatively, you may join by phone using one of the following numbers:

Italy: +39 06 83360400

UK: +44 (0) 33 0551 0200

USA: +1 786 697 3501

The presentation will be available at the start of the event in the “Investors/Financial Results” (Financial Results | Maire) section of MAIRE’s website (groupmaire.com). The presentation shall also be made available on the “1info” storage mechanism (www.1info.it).

1 EBITDA is net income for the period before taxes (current and deferred), net financial expenses, gains and losses on the valuation of holdings, amortization and depreciation and provisions.

2 Deferred price and earn-out components related to M&A transactions are included at closing of the transactions and may result in a cash outflow in the following periods.

3 H1 2024 figure includes the total acquisition price for HyDEP and GasConTec, as well as for the additional stakes in MyReplast and MyReplast Industries.

4 H1 2025 figure includes the deferred price for the acquisition of MyRemono, closed in 2023.

5 Excluding leasing liabilities – IFRS 16 (€120.9 million as of 30 June 2025 and €136.6 million as of 31 December 2024) and other minor items.

6 The changes reported refer to H1 2025 compared with H1 2024, unless otherwise stated.

7 Of which €114.5 million paid to MAIRE shareholders and €5.0 million paid on minority interests.

8 As communicated to the market on 4 March 2025 with the 2025-2034 Strategic Plan and confirmed on 29 April 2025 with the release of the first quarter 2025 financial results.

***

Mariano Avanzi, as Executive for Financial Reporting with, also, responsibility for certification as per paragraph 5-ter regarding Sustainability reporting - declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records. The Half-Year Financial Report as of 30 June 2025 will be available to the public at the registered office in Rome, at the operative office in Milan, on the Company’s website www.groupmaire.com in the “Investors/Financial Results” section (Financial Results | Maire), and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law. This document makes use of some alternative performance indicators. The management of the Company considers these indicators key parameters to monitor the Group’s economic and financial performance. As the represented indicators are not identified as accounting measurements according to IFRS standards, the Group calculation criteria may not be uniform with those adopted by other groups and, therefore, may not be comparable. This press release includes forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including altered macroeconomic conditions and8 growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.