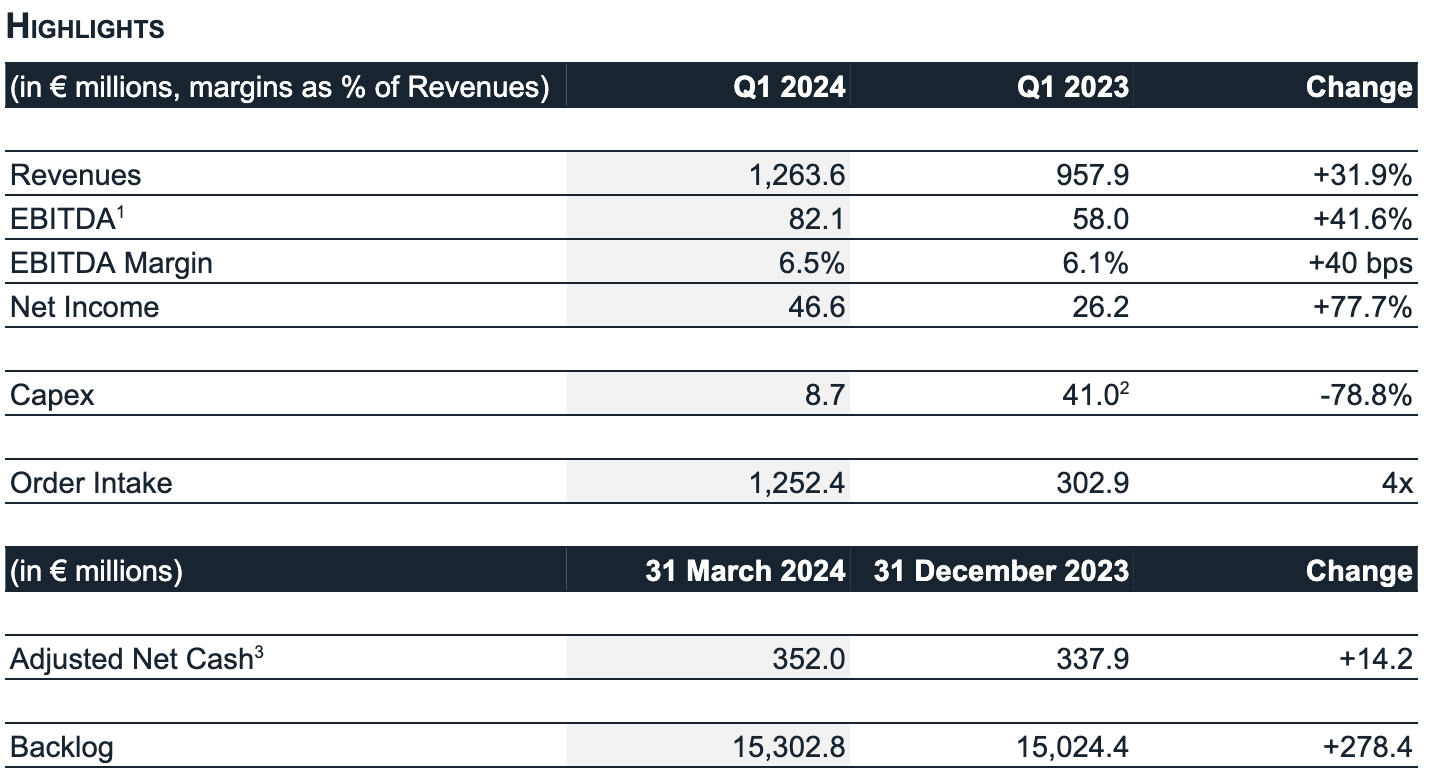

- Robust start to the year with double-digit growth of the main economic metrics:

- Revenues of €1.3 billion (+31.9%)

- EBITDA of €82.1 million (+41.6%) with a margin increased from 6.1% to 6.5%

- Net income of €46.6 million (+77.7%)

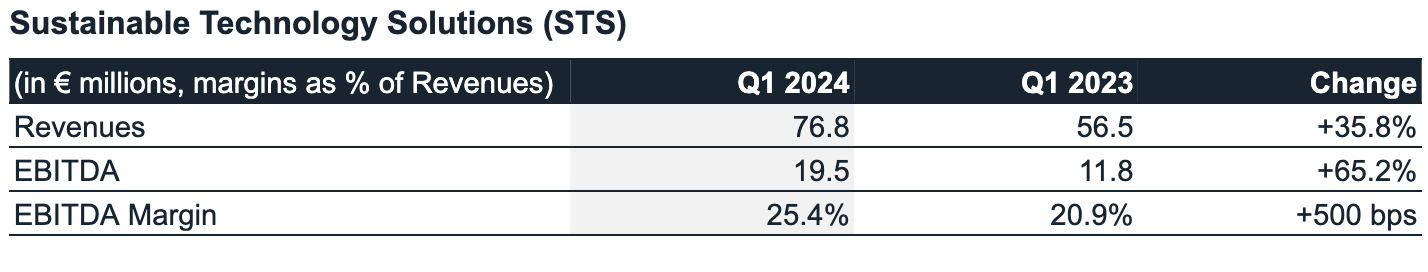

- Excellent performance of Sustainable Technology Solutions, generating revenues of €76.8 million (+35.8%) and EBITDA of €19.5 million (+65.2%), with a margin increased from 20.9% to 25.4%

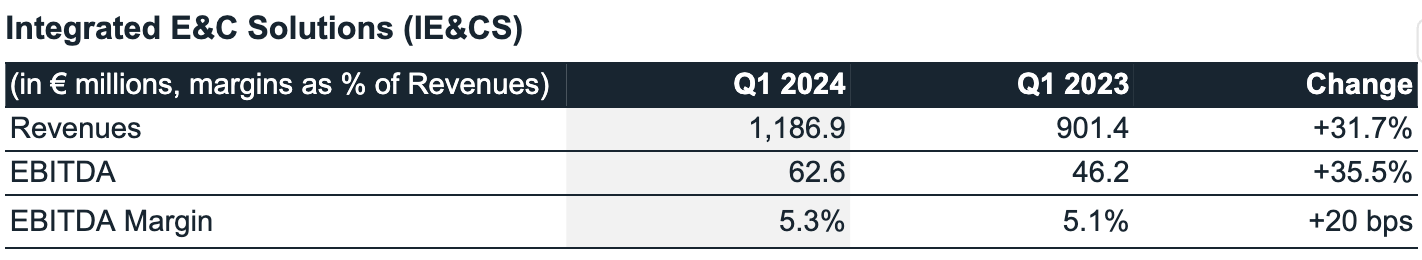

- Strong growth of Integrated E&C Solutions, generating revenues of €1.2 billion (+31.7%) and EBITDA of €62.6 million (+35.5%), also thanks to the contribution of the Hail and Ghasha project, which is progressing according to project’s schedule

- Adjusted Net Cash Position of €352.0 million, up €14.2 million compared to the end of 2023, net of €8.7 million capex and €21.0 million share buy-back program

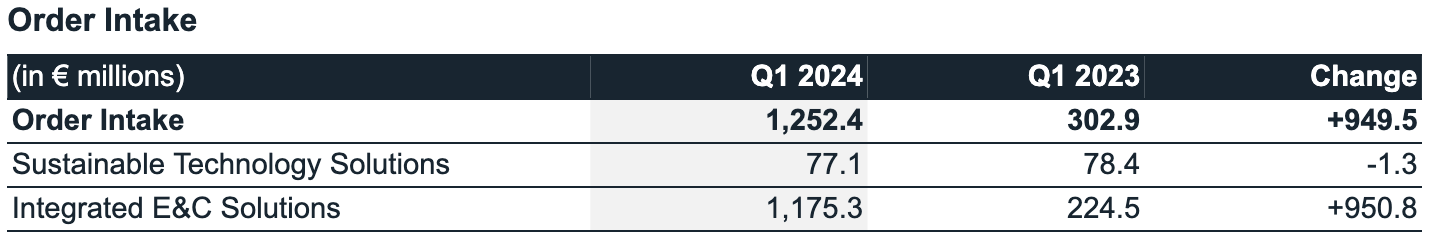

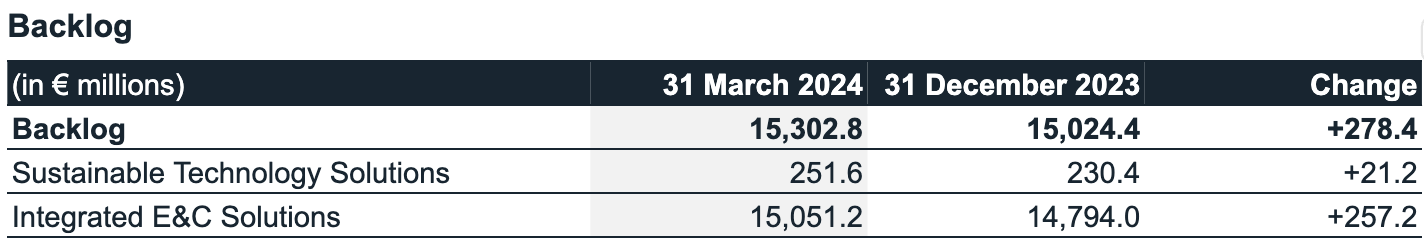

- Order intake at €1.3 billion, contributing to a solid backlog of €15.3 billion, up €278.4 million compared to the end of 2023

- Hired 568 new professionals, of which 108 women, to support execution capability while enhancing diversity and inclusion

- Signed binding agreements for the acquisition of HyDEP and GasConTec, which will support the expansion of NEXTCHEM’s technology offering

- Distributed a dividend of €0.197 per share, up 59% from 2023, for a total amount of €63.5 million, with payment on today’s date

- 2024 Guidance confirmed for all economic and financial KPIs

Milan, 24 April 2024 – The Board of Directors of MAIRE S.p.A. (“MAIRE” or the “Company”) met today to review and approve the Group’s Interim Financial Report as of 31 March 2024.

Alessandro Bernini, Chief Executive Officer of MAIRE, commented:

“We are pleased with the first quarter results we presented today: we continue to achieve a double-digit growth in the main indicators, thanks to a steady project execution and an increasing contribution from high value-added solutions. We also keep enhancing our technology offering to support industry decarbonization, including the acquisitions of HyDEP and GasConTec, which we expect to complete in the next weeks. The robust market demand in the downstream segment and the sizeable commercial opportunities – some of which we are confident could be finalized in the next weeks – will provide a solid foundation to the Group’s growth in the years to come, in line with the Strategic Plan we announced in March.”

CONSOLIDATED FINANCIAL RESULTS AS OF 31 MARCH 20244

Revenues were €1,263.6 million, up 31.9%, mainly thanks to the progress of projects under execution, including the engineering and procurement activities of Hail and Ghasha.

EBITDA was €82.1 million, up 41.6%, thanks to higher revenues and the efficient management of overhead costs. EBITDA Margin was 6.5%, up 40 basis points, also thanks to an increased contribution from technologies and high value-added services.

Amortization, Depreciation, Write-downs, and Provisions were €15.3 million, up €3.1 million due to the marketing of new patents and technological developments, as well as the start into operation of assets for the digitalization of industrial processes.

EBIT was €66.8 million, up 45.7%, with a margin of 5.3%, up 50 basis points.

Net Financial Income was €0.3 million, compared to €8.4 million of Net Financial Charges, also thanks to the positive variation of the mark-to-market of certain derivative instruments, as well as an higher yield on cash deposits.

Pre-tax Income was €67.1 million and the tax provision was €20.5 million. The effective tax rate was 30.5%, substantially in line with the last quarters.

Net Income was €46.6 million, up 77.7%, with a 3.7% margin, up 100 basis points.

Adjusted Net Cash as of 31 March 2024, excluding leasing liabilities (IFRS 16) and other minor items, was €352.0 million, increasing by €14.2 million versus 31 December 2023. Operating cash generation more than compensated the share buy-back program for €21.0 million and capital expenditures for a total value of €8.7 million, which were mainly dedicated to the expansion of the technology portfolio and to digital innovation projects.

Consolidated Shareholders’ Equity was €591.3 million, up €11.6 million versus 31 December 2023, positively impacted by the profit of the period, net of the share buy-back and the impact of exchange rate fluctuations.

PERFORMANCE BY BUSINESS UNIT

Revenues amounted to €76.8 million, up 35.8%, thanks to the constant growth recorded in technological solutions and services mainly in nitrogen fertilizers and low-carbon circular fuels and chemicals.

EBITDA was €19.5 million, up 65.2%, thanks to higher volumes and a different mix of technological solutions, with a margin of 25.4%, up 500 basis points.

Revenues amounted to €1,186.9 million, up 31.7%, mainly thanks to the progress of projects under execution, including the engineering and procurement activities of Hail and Ghasha.

EBITDA was €62.6 million, up 35.5%, and with a margin of 5.3%, up 20 basis points.

ORDER INTAKE AND BACKLOG

Order Intake in the first quarter was €1,252.4 million.

In particular, the Sustainable Technology Solutions business unit (NEXTCHEM Group) generated new orders for €77.1 million. The main projects awarded in the first quarter to this business unit include:

- licensing and engineering design package for the application of the proprietary NX CPOTM technology in Norsk’s e-Fuel industrial-scale plant that will produce Sustainable Aviation Fuel in Norway;

- licensing and equipment supply for a urea melt plant in China based on STAMI UreaTM technology with the proprietary Ultra-Low Energy design;

- licensing and equipment supply based on STAMI UreaTM proprietary technology for a urea melt and granulation plant in Egypt;

- process design package related to Aliplast’s (Hera Group) new plastic upcycling plant in Italy based on the proprietary NX ReplastTM technology;

- several engineering and feasibility studies.

The Integrated E&C Solutions business unit generated new orders for €1,175.3 million. The main projects awarded in the first quarter to this business unit include:

- a Front-End Engineering Design (FEED) for a large-scale green ammonia plant in Norway by Fortescue;

- a Front-End Engineering Design for a green hydrogen and ammonia plant in Portugal by MadoquaPower2X;

- an Engineering, Procurement and Construction (EPC) contract for a hydrogen production unit, as part of ENI’s conversion of its Livorno site into a biorefinery;

- an Engineering, Procurement, Construction and Commissioning (EPCC) contract for a new petrochemical plant by SONATRACH in Algeria.

As a result of the order intake of the period, the Group's Backlog at 31 March 2024 amounted to €15,302.8 million.

SUBSEQUENT EVENTS AFTER THE CLOSE OF THE PERIOD

Ordinary and Extraordinary Shareholders’ Meeting

The Ordinary and Extraordinary Shareholder’s Meetings of MAIRE held on 17 April 2024, among other items, approved the Financial Statements as of 31 December 2023 and the distribution of a dividend of €0.197 per share, up 59% compared to last year with payment on today’s date. Taking into account the treasury shares held in portfolio by MAIRE, as of 23 April 2024 (so-called record date), the total dividend to be paid is equal to €63,466,967.16. Additionally, the Shareholders’ Meeting adopted certain resolutions on governance and remuneration matters, as well as authorized the purchase and disposal of treasury shares and certain amendments to the Company’s Articles of Association, including the change of the Company’s name to “MAIRE S.p.A.”, which was already envisaged as abbreviated form.

Acquisition of an additional 34% stake in MyReplast Industries and MyReplast

On 19 April 2024, NextChem Tech purchased an additional stake of the share capital in both MyReplast Industries S.r.l. and MyReplast S.r.l., equal to 34% in each, increasing its interest from 51% to 85% of the share capital of both companies. The overall maximum consideration for said acquisition is about €8.9 million. Based in Bedizzole (Italy), MyReplast Industries operates an innovative upcycling plant producing high-purity recycled and compounded polymers, based on NX ReplastTM technology patented by MyReplast S.r.l.

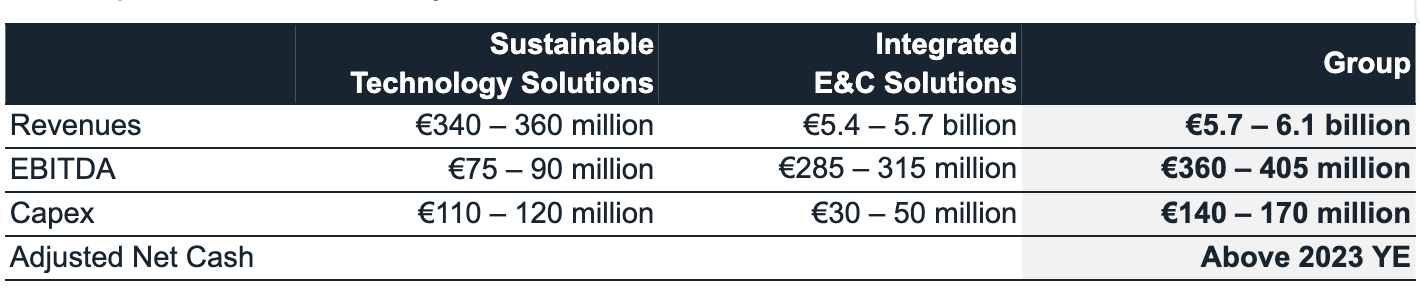

2024 GUIDANCE

In light of the above, particularly the significant backlog, the Company confirms the guidance for 2024 disclosed with the 2024-2033 Strategic Plan on 5 March 2024, which includes the following KPIs expected for the current year:

Revenues of both business units are expected to grow progressively during the year. STS will benefit, among others, from the expected contribution of the companies which will enter the NEXTCHEM’s Group business perimeter. IE&CS will be supported by the current backlog, particularly by the expected progress of engineering and procurement activities of recently awarded contracts, including Hail and Ghasha.

Capital expenditures will continue to focus on the technology portfolio expansion to foster the energy transition, including through selected add-on acquisitions, as well as on digital innovation.

Notwithstanding higher investments and the dividend distribution, Adjusted Net Cash is expected to improve compared to the end of 2023.

UPDATE ON THE EXPANSION OF STS BUSINESS UNIT TECHNOLOGY OFFERING

During the first months of 2024, MAIRE progressed in the implementation of the strategy aimed at expanding the technology offering of the business unit Sustainable Technology Solutions (NEXTCHEM Group), including through the acquisition of proven technologies and competences, as well as partnerships and joint development agreements with third parties. In particular, during the first quarter 2024, binding agreements were signed for the acquisition of 80% of HyDEP, an engineering services company based in Italy with a strong expertise in green hydrogen, and 100% of Germany-based GasConTec, owner of a portfolio of distinctive technologies for the synthesis of several low carbon products which are strategically complementary to NEXTCHEM’s offering. The closing of both of these acquisitions is expected in the coming weeks.

Additionally, NEXTCHEM’s companies signed the following agreements:

- cooperation agreement with newcleo to develop the “e-Factory for carbon-neutral chemistry”, thanks to newcleo’s innovative clean and safe nuclear technology;

- cooperation agreement with ENGIE to develop and commercialize an advanced technology to produce synthetic methane from dry biomass waste;

- agreement with Milan Polytechnic (POLIMI) for the joint development of innovative catalysts for the energy transition;

- agreement with Vallourec to integrate NEXTCHEM’s proprietary green ammonia technology with Vallourec’s hydrogen storage solution in “Power-to-X” and green hydrogen projects.

UPDATE ON THE ORGANIC GROWTH OF THE GROUP

To support the Group’s growth, MAIRE continues to invest in acquiring new talent. Headcount reached around 8,300 employees from about 80 nationalities as of 31 March 2024, up 4% since the end of 2023, also thanks to the hiring of 568 professionals during the first quarter of 2024, of which 108 women. While the headcount is expected to keep growing significantly to fuel the growth ambitions envisaged in the 2024-2033 Strategic Plan, the Group remains deeply committed to the flourishing of its people and to fostering an even more diverse and inclusive environment.

***

The Board of Directors today has determined that board member Isabella Nova, appointed on 17 April 2024 pursuant to art. 2386 of Italy’s civil code, possesses the necessary requirements pursuant to the CFA and the Corporate Governance Code, also taking into account the quantitative and qualitative criteria defined by the Board of Directors to evaluate the significance of the relationships as per letter c) and eventual additional remuneration as per letter d) of recommendation 7 of the Corporate Governance Code.

The Board of Statutory Auditors, as part of the duties assigned to it by law, today verified that the correct application of the criteria and procedures for assessment was adopted by the board of directors to evaluate the independence of Director Isabella Nova.

***

UPDATE ON THE EURO COMMERCIAL PAPER PROGRAMME

With reference to the Euro Commercial Paper program launched in 2021 by MAIRE for the issuance of one or more non-convertible notes placed with selected institutional investors for a maximum amount of €150 million, it should be noted that as at 31 March 2024 the program is utilized for an amount of €57.8 million. The notes will expire in several tranches between May 2024 and February 2025. The weighted average interest rate is 5.294%.

***

CONFERENCE CALL AND WEBCAST

The top management of MAIRE will present the Q1 2024 Results during a conference call today at 5:30pm CEST.

The live stream of the event can be accessed at the following link:

MAIRE Q1 2024 Results Conference Call (royalcast.com)

Alternatively, you may join by phone using one of the following numbers:

Italy: +39 06 83360400

UK: +44 (0) 33 0551 0200

USA: +1 786 697 3501

The presentation will be available at the start of the event in the “Investors/Financial Results” section of MAIRE’s website (Financial Results | Maire (mairetecnimont.com)). The presentation shall also be made available on the “1info” storage mechanism (www.1info.it).

***

Fabio Fritelli, as Executive for Financial Reporting, declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The Interim Financial Report as of 31 March 2024 will be available to the public at the registered office in Rome, at the operative office in Milan, on the Company’s website www.mairetecnimont.com (in the “Investors/Financial Results” section), and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law.

This document makes use of some alternative performance indicators. The management of the Company considers these indicators key parameters to monitor the Group’s economic and financial performance. As the represented indicators are not identified as accounting measurements according to IFRS standards, the Group calculation criteria may not be uniform with those adopted by other groups and, therefore, may not be comparable.

This press release includes forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including altered macroeconomic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.

1 EBITDA is net income for the year before taxes (current and deferred), net financial expenses, gains and losses on the valuation of holdings, amortization and depreciation and provisions.

2 Including €35.8 million for the acquisition of 83.5% of Conser S.p.A., not taking into account €17.6 million acquired cash, and €5.2 million of organic capex.

3 Excluding leasing liabilities – IFRS 16 (€131.8 million as of 31 March 2024 and €129.1 million as of 31 December 2023) and other minor items.

4 The changes reported refer to Q1 2024 versus Q1 2023, unless otherwise stated.

5 On 23 April 2024, the so-called record date, MAIRE S.p.A holds no. 6,473,086 treasury shares in its portfolio, resulting from the treasury share buyback Program dedicated to “2021-2023 Long-term Incentive Plan of the Maire Tecnimont Group” and the First Cycle (2023) of the "Maire Tecnimont Group’s Employees Share Ownership Plan 2023-2025" announced to the market on 18 March 2024 and concluded on 12 April 2024.

6 Of which €5.1 million paid at closing and €3.8 million deferred (including an earn-out) to be paid on annual basis according to the achievement of several milestones until 31 December 2027.